Particl Perspective: Tariffs in 2025

Tariffs and E-Commerce in 2025: Strategic Responses from DTC Brands

Executive Summary

Tariff policy shifts in 2025 have created meaningful cost challenges for U.S.-based e-commerce retailers. From high-profile fashion brands like Alo Yoga and Vuori to consumer goods sellers on Amazon, companies are raising prices, restructuring supply chains, and accelerating the use of data-driven pricing strategies. Using real-time data from the Particl database, this report explores how signature brands are managing rising costs through targeted price increases, communication tactics, and operational changes.

The New Tariff Landscape

Recent U.S. trade policy has increased tariffs across apparel and consumer goods, particularly from China, Mexico, Vietnam, and Bangladesh. For fashion and lifestyle brands, tariff rates rose from an average of 14.5 percent in 2024 to over 30 percent in 2025. This has inflated import costs for categories like leggings, socks, and beauty products, creating ripple effects in e-commerce pricing and brand strategy.

Tariff Rate Changes by Country

Comparison of 2024 and 2025 Tariff Rates

Pricing Strategy: Navigating Elasticity

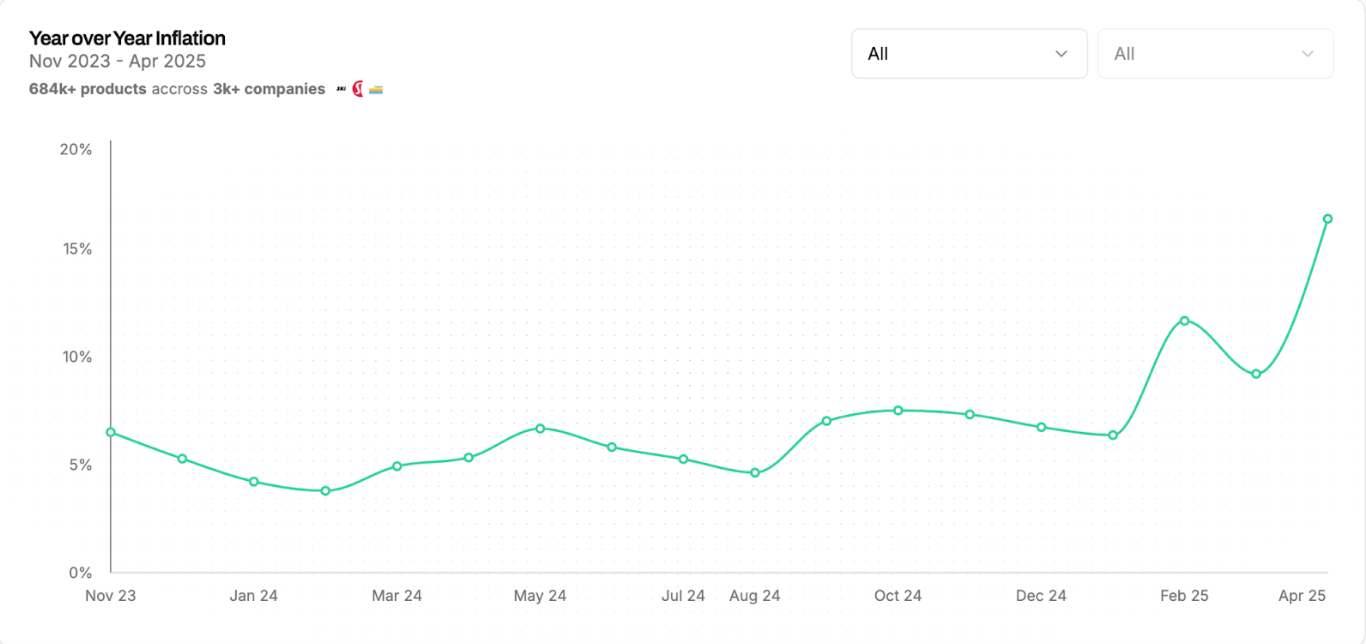

Particl data reveals steep price hikes across verticals. From February to April 2025, average online prices jumped from 9.6 percent to over 17 percent year-over-year. Health & Beauty saw 45 percent inflation, while Apparel & Accessories rose over 25 percent.

Signature brands are adjusting:

- Alo Yoga raised prices on its crew neck sweaters from $118 to $128 between October 2024 and May 2025. Socks rose 16 percent between December and May alone.

- Vuori expanded U.S. warehousing and rerouted supply chains in response to tariffs and shipping delays from Mexico.

- SKIMS increased prices modestly while emphasizing value and product versatility in campaigns.

These pricing changes reflect a dual imperative: protect margins while maintaining consumer trust.

Apparel in Focus: Strategic Moves from Signature Brands

- Alo Yoga has implemented steady pricing lifts on socks and core products, positioning price hikes as value-driven improvements (e.g., material quality, design, limited drops). Particl charts show consistent growth rates since September 2024.

- Vuori responded to tariff shocks and cross-border shipment disruptions by investing in a new U.S. warehouse to improve fulfillment reliability and mitigate risk.

- SKIMS, though less transparent in public forums, is likely pursuing a mix of supplier diversification and pricing moderation to stay competitive.

Brands like Everlane and Mejuri show double-digit annual pricing gains, while others such as BYLT and Gymshark demonstrate more price resistance—underscoring strategic bifurcation in the apparel market.

Everlane Monthly Average Prices

Monthly average prices from August 2022 to June 2025

Product Spotlight: Socks as a Tariff-Tested Growth Lever

Socks have emerged as a high-leverage category for pricing growth. Alo Yoga’s average sock prices rose from $27.82 to $32.43 between late December 2024 and May 2025.

Why brands love this category:

- Low base price makes percent gains more visible.

- Low elasticity—consumers are less sensitive to $2 increases.

- Value perception—material or packaging tweaks justify price hikes.

- Rising COGS—cotton, elastane, and bulk shipping inflate costs quickly.

- Brand and gifting value—easily positioned as seasonal or lifestyle essentials.

Growth trends:

- Alo Yoga’s sock prices show consistent upward growth from Q4 2024 through Q2 2025.

- Particl data confirms multiple consecutive months of positive growth rate changes.

- Year-to-date growth through May 2025 stands at 4.53 percent.

Broader E-Commerce Effects and Consumer Trends

While some categories like Health & Beauty and Apparel are seeing inflation, others—especially Home & Garden—are facing steep deflation due to overstock, declining demand, and intensified discounting. This polarization in pricing highlights the importance of agile pricing strategy by vertical.

Meanwhile, some brands are turning tariffs into brand storytelling opportunities. Transparent pricing emails and landing pages that explain the rationale behind cost increases are helping mitigate backlash and maintain trust.

Operational Shifts and Long-Term Resilience

Strategic responses include:

- Supply chain realignment from China to Vietnam, India, and Mexico

- Investment in U.S. infrastructure, like Vuori’s new warehouse

- Inventory stockpiling to get ahead of future tariffs

- Adoption of AI tools for pricing and demand forecasting

Brands are also facing a smaller margin for error. With the closure of the de minimis exemption, many DTC players can no longer import small packages tariff-free, adding further cost pressure.

Looking Ahead

The winners in this evolving tariff environment will be those who:

- Communicate clearly with customers

- Build flexible, multi-region supply chains

- Lean into pricing power where possible, especially on low-elasticity SKUs

- Use data to inform real-time adjustments

Tariffs are out of a brand’s control—but pricing, messaging, and product strategy are not.