Origin Matters: Why the Future of Apparel Begins at the Fiber

Data powered by Particl in collaboration with Supima

Executive Summary

Cotton origin is no longer just an ESG talking point. It's emerging as a key lever in product differentiation, customer trust, and commercial growth. Consumers are more discerning than ever, and traditional apparel value propositions like fit and price are plateauing. Brands that go deeper, telling authentic, origin-based fiber stories, are winning attention and revenue.

In this report, we use product and SKU-level sales data from Particl and forensic authentication insights from Supima to explore how cotton origin is shaping the future of the apparel industry. We highlight brand case studies, analyze trends in PDP marketing and product performance, and outline the tools available to help brands verify and commercialize their fiber stories.

Our Proposition

Cotton origin is the next frontier in apparel differentiation, and most brands aren’t ready. As traditional levers like fit, price, and silhouette mature, fiber sourcing has become a blind spot with growing commercial, ESG, and regulatory implications.

The Particl database projects that global spend on Supima products alone is over $500M for the year 2025, based on a dataset of ~250 top products and ~2,000 best-selling products.

Global Spend on Supima Products (Top 250 Brands)

Annual online revenue across ~2,000 top Supima-tagged products from leading DTC and wholesale brands (in millions USD)

I. Fiber Origin Is the Next Apparel Frontier

Consumers expect more from the brands they buy from: more transparency, more accountability, and more meaning behind the products. At the same time, the rise of e-commerce has made visual sameness and product fatigue a real problem.

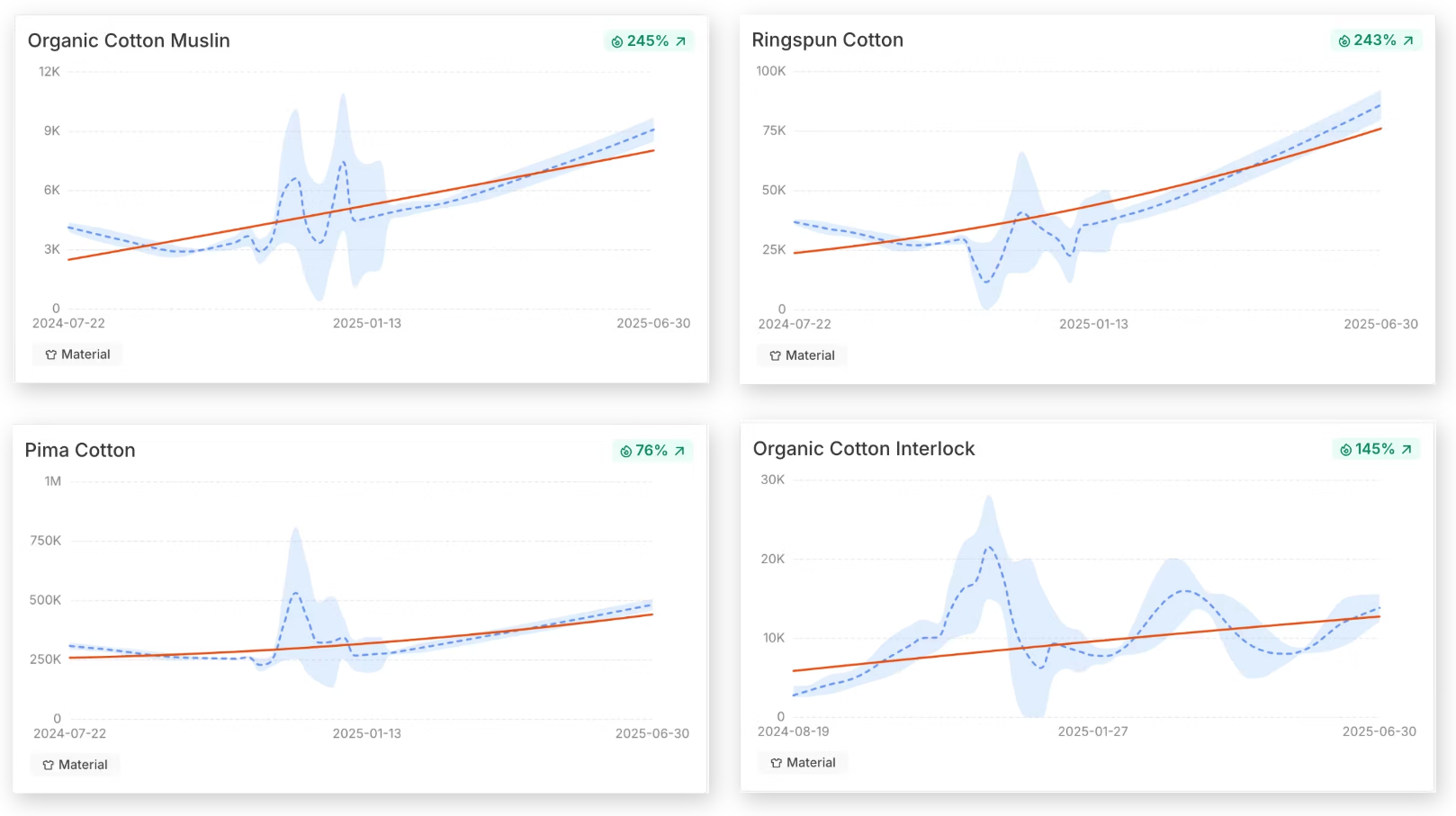

Origin-backed fiber stories offer a rare win-win. They deepen consumer trust, strengthen ESG positioning, and, when marketed effectively, drive sales. Below are several examples from the Particl Trends Tool demonstrating strong growth over the last 12 months.

Image Source: Particl Trends Tool

II. Origin-Backed Cotton Products Outperform

What the Data Shows

Particl and industry data indicate that cotton products marketed with terms like "Supima," "US-grown cotton," "100% Cotton," or "Organic Cotton" outperform category baselines in key metrics (see Sources section for more information).

- According to Cotton Incorporated, 78% of consumers say "100% cotton" claims influence their purchases.

- Sales of organic and region-specific cotton have grown year over year, driven by trust and perceived quality.

- Under Armour's Charged Cotton line surpassed $300M in revenue after launching with a clear fiber performance narrative.

Under Armour Charged Cotton Online Sales (Apr 2024–Jul 2025)

Monthly online revenue for Under Armour Charged Cotton apparel products (normalized scale)

III. The Trust Gap: Most Brands Don't Know Where Their Cotton Comes From

Despite the clear consumer and commercial upside, most apparel brands still operate with limited visibility into fiber sourcing. They rely on supplier-provided claims, which are often unverifiable, or worse, inaccurate.

This opens up several risks or missed opportunities:

- ESG exposure: regulators and watchdogs are increasingly targeting unsubstantiated claims

- Brand trust erosion: consumers are skeptical of vague or generic sustainability messaging

- Missed growth: without verifiable sourcing, brands can't fully leverage origin as a commercial asset

- Rising tariffs: import duties on foreign textiles make U.S.-grown cotton more cost-competitive

- New legislation: the Buying American Cotton Act would offer tax credits for verified U.S. cotton use

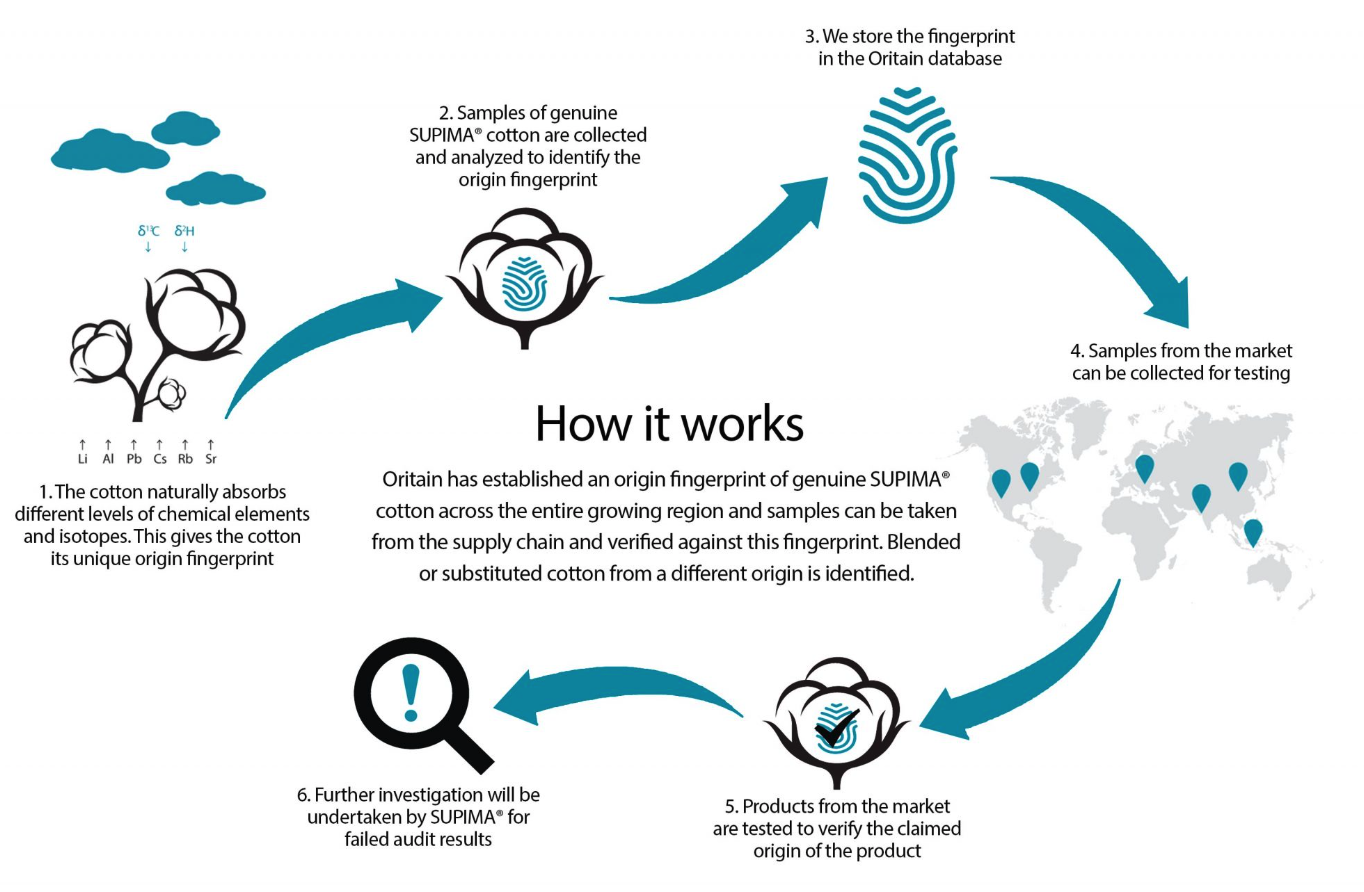

Notional flow chart of Supima's Fiber Forensics process to ensure origin transparency with Supima cotton

IV. The Solution: Supima + Particl

Supima's Forensic Authentication Platform

Supima has partnered with global forensic leaders like Oritain to authenticate cotton down to its geographic origin.

Key technologies include:

- Oritain geochemical fingerprinting: Uses naturally occurring trace elements to verify fiber origin with 99.5% confidence

- TextileGenesis blockchain: Creates a digital twin of the cotton's journey through the supply chain

- AQRe™ traceability: Combines physical testing and digital records for end-to-end transparency

Since its launch in July 2023, AQRe™ has doubled year-over-year product integration and now supports 800+ suppliers and 215 brands, with 90 achieving full traceability. Today, it authenticates 1 in 3 bales of exported American Pima cotton, powering a real-time demand funnel and enabling Supima to become a self-funded, service-driven partner for brands pursuing authenticity at scale.

These tools combat counterfeiting, support ESG compliance, and offer defensible proof for marketing and sourcing teams. Increasingly, brands are adopting Supima's platform for its real-time traceability, forensic verification, and ability to reinforce brand credibility in a competitive marketplace.

Particl's Commercial Lens

Particl aggregates SKU-level data across top DTC and wholesale brands, tracking:

- Sales performance of products with and without fiber origin claims

- Trends in PDP language, campaign assets, and keyword frequency

- Category-level whitespace and performance benchmarks

Together, Supima and Particl provide the foundation for product integrity and commercial clarity. Brands can use Supima's forensic tools to verify and market their fiber origin, then turn to Particl to measure downstream performance, benchmark against peers, and identify high-potential categories where traceability unlocks meaningful revenue growth.

V. Brand Highlights: Who's Getting It Right

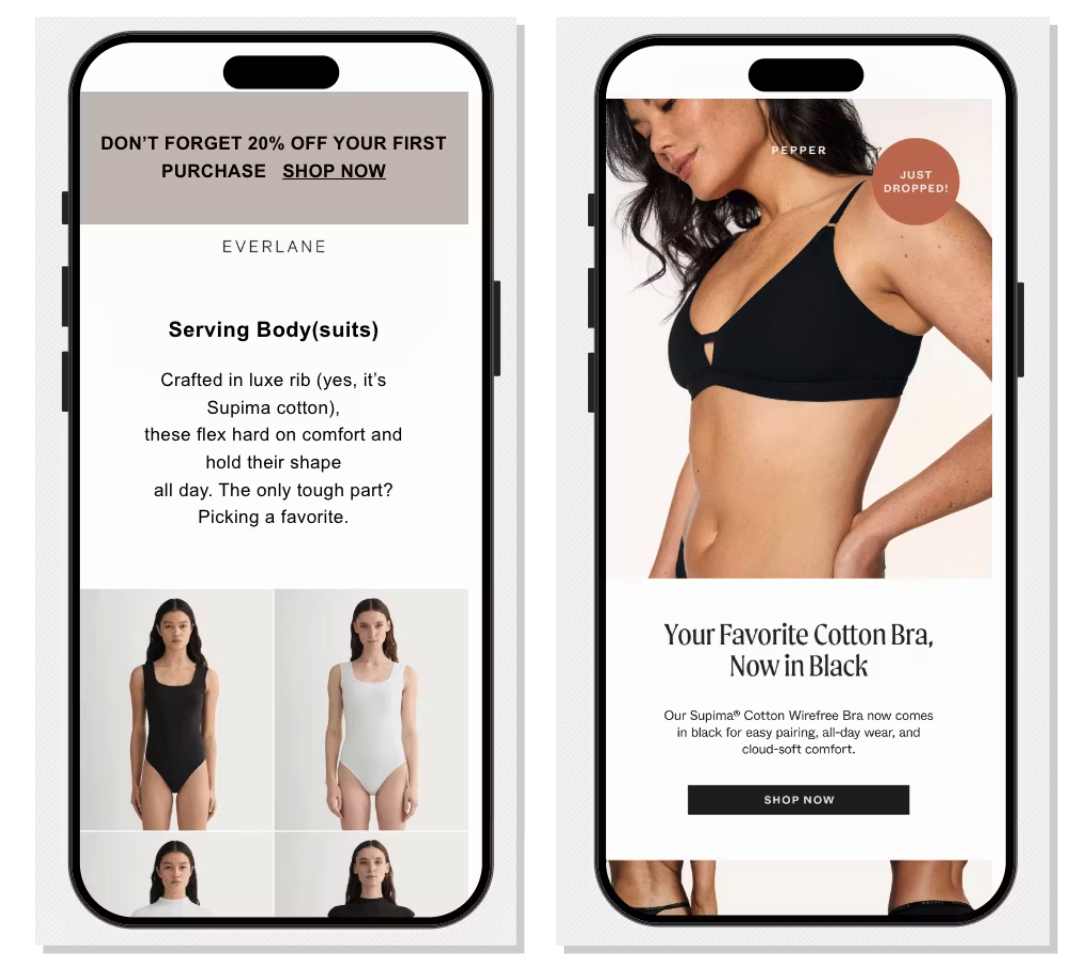

Everlane & Pepper

Focus: Verified quality, traceable comfort, and story-driven cotton sourcing

- Both brands integrate Supima cotton across essential styles to highlight softness, durability, and ethical sourcing

- Use of Supima is woven into PDP language and supported by email campaigns that emphasize quality and traceability

- These brands show how origin-backed fiber can power both product performance and emotional resonance with consumers

Email campaigns from Everlane and Pepper highlighting Supima cotton in their core apparel products

MATE The Label

Focus: Sustainability and traceability

- Uses organic cotton and U.S. origin in its positioning

- Strong language around certifications and responsible sourcing

Mate the Label Online Sales (Aug 2022 – Jul 2025)

Monthly normalized online revenue for Mate the Label’s total product catalog

Mate the Label's online revenue more than tripled from $599K in August 2022 to over $2.1M by November 2024, driven by strong seasonal peaks and growing demand for its essentials.

Christy Dawn

Focus: Regenerative cotton, farm-to-closet narrative

- Builds full storytelling arc around cotton origin and regenerative agriculture

- Connects sourcing to broader climate and biodiversity impact

Christy Dawn Online Sales (Jan 2022 – Jul 2025)

Monthly normalized online revenue for Christy Dawn’s total product catalog

Christy Dawn's monthly online revenue grew from under $800K in January 2022 to over $1.3M by November 2024, highlighting steady momentum and strong performance during key seasonal periods.

Buck Mason

Focus: Elevated essentials, American-grown Supima cotton

- Buck Mason’s best-selling Pima Cotton Tee is made with certified Supima cotton and has become a foundational product for the brand

- Supima origin plays a central role in the brand’s positioning around quality, comfort, and longevity

Buck Mason Online Sales (Jan 2023 – Jul 2025)

Monthly normalized online revenue for Buck Mason’s total product catalog

Buck Mason’s online monthly revenue grew nearly 7x from $2.2M in January 2023 to over $15M by May 2025, driven in large part by the brand’s Supima Pima Cotton Tee, a staple that anchors its core assortment.

VI. Call to Action

Fiber origin is no longer a backend sourcing detail. It's a front-of-house lever for growth, trust, and product strategy. Brands that verify their sourcing, tell authentic stories, and use data to optimize their assortment are better equipped to:

- Stand out in crowded categories

- Build durable ESG credibility

- Convert high-intent customers

Supima's AQRe™ platform offers end-to-end cotton authentication at scale, supported by robust onboarding, data-backed ROI tools, and ongoing education. Particl complements this with commercial insight, connecting verified sourcing strategies to real-world product performance and merchandising decisions. Together, Supima and Particl are shaping a new future of data-driven product strategy—from fiber to final sale.