Sportstyle vs. Gorpcore: The Blurring Lines of Performance Footwear

Introduction

Footwear is undergoing a quiet revolution. While traditional sneaker categories like performance running or streetwear staples still dominate volume, a once-niche segment, Sportstyle has quickly become one of the fastest-growing areas in the space. Defined by its blend of athletic heritage and fashion-first intent, sportstyle footwear shares some DNA with gorpcore, a trend that prioritizes technical outdoor gear as a style statement. But despite their overlap, sportstyle and gorpcore represent distinct consumer mindsets and usage occasions, and that distinction is increasingly important as brands chase growth in both lanes.

Defining the Differences

Sportstyle shoes take design cues from performance footwear, like trail runners, skate shoes, and retro trainers, and remix them for daily, urban wear. Comfort and performance are still valued, but style and versatility take center stage. Think of shoes like the ASICS GEL-NYC or Salomon XT-6 worn not for their running specs, but for how they look with cargos or cropped trousers.

Gorpcore, by contrast, celebrates true utility. Borrowed from outdoor culture (the name comes from "Good Ol' Raisins and Peanuts," a trail mix staple), gorpcore outfits rely on technical jackets, cargo pants, and rugged trail shoes. It is gear originally built for the backcountry, now worn in the city. Brands like Arc'teryx, The North Face, and Merrell dominate this world, with materials like Gore-Tex, Vibram, and Cordura signaling durability and function.

In short, sportstyle nods to performance. Gorpcore is performance, repurposed for fashion.

ASICS and the Rise of Retro-Technical Cool

ASICS has seen a strong resurgence over the past two years thanks to its retro-meets-technical GEL line. Models like the GEL-Kayano 14, GEL-NYC, and GEL-1130 incorporate running shoe tech like GEL™ cushioning and breathable uppers but are styled to appeal to streetwear fans and fashion-forward consumers. They offer authenticity and function, without compromising visual appeal.

ASICS has benefited from both independent consumer enthusiasm and strategic brand collaborations that have pushed its models into the fashion spotlight. Its growing success in sportstyle demonstrates that performance credibility can drive aesthetic adoption.

ASICS Online Sportstyle Revenue (Jun 2024 – Jun 2025)

Monthly online revenue from ASICS products tagged 'Sportstyle' (in millions USD)

Collaboration and Crossover: The Salomon Effect

Few brands have bridged the gap between gorpcore and sportstyle as effectively as Salomon. Known for their technical trail gear, the brand's XT-6 and Speedcross shoes have achieved cult status through collaborations with labels like MM6 Maison Margiela and The Broken Arm. These partnerships have elevated Salomon into the fashion conversation while keeping its trail-running DNA intact.

Salomon’s performance features, such as aggressive tread patterns, breathable materials, quick-lacing systems, remain core to the product. But the brand’s ability to appeal across audiences, from hikers to hypebeasts, has been critical to its recent growth.

Salomon Australia Online Store Revenue (Mar–Jun 2025)

Monthly sales revenue from Salomon’s Australian online store (in millions USD)

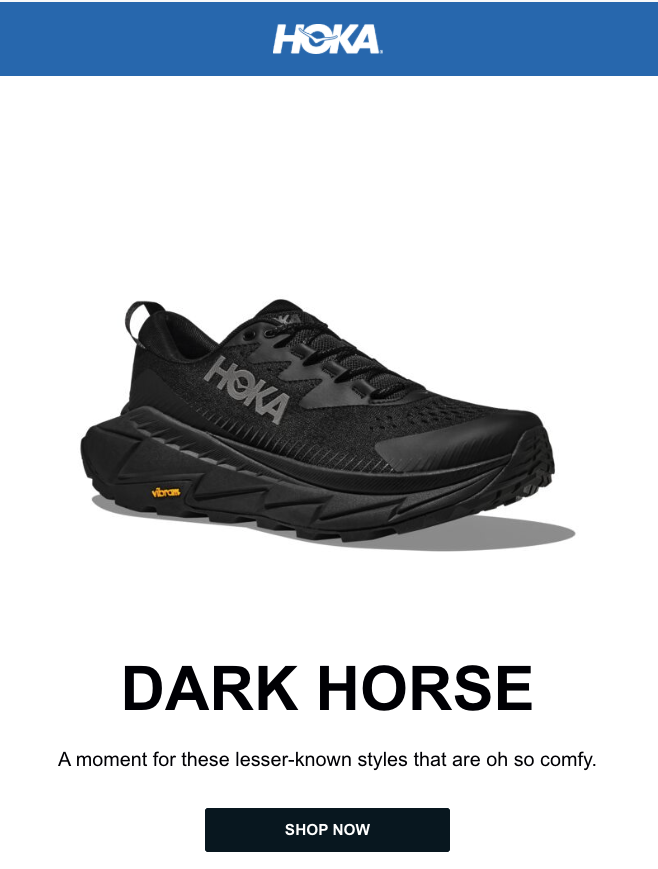

HOKA and the Era of Maximal Comfort

HOKA entered the footwear scene with maximalist cushioning and an orthopedic aesthetic that once polarized consumers. Today, it's a breakout success. Styles like the Bondi and Speedgoat are not only beloved by runners and walkers but also by fashion-conscious consumers embracing comfort-first silhouettes.

What sets HOKA apart is its ability to combine serious performance credentials, such as thick midsoles, rockered geometry, and grippy outsoles with vibrant color palettes and sculptural forms. While some models lean more performance and others more street, HOKA now plays in both sportstyle and gorpcore circles. It has also gained traction through brand collabs and fashion editorial features, proving that comfort can be both stylish and aspirational.

Arc'teryx and the Broader Outdoor Boom

Arc'teryx may not be a footwear brand first, but its influence on gorpcore is unmatched. Originally designed for alpine conditions, its gear, especially pieces like the Atom Hoody and Beta Shells, is now worn far from the mountains. Urban consumers have embraced Arc'teryx not just for its function, but for the status it signals.

With the launch of its System_A and Veilance lines, Arc'teryx has deliberately moved into lifestyle territory. Still, the brand refuses to dilute its technical roots. The result is a highly covetable, high-performance aesthetic that anchors gorpcore styling. Additionally, its footwear line has seen positive growth over the last two years (see below).

Arc'teryx Online Footwear Revenue (Apr 2023 – Jun 2025)

Monthly revenue from Arc'teryx footwear products sold via online channels (in millions USD)

A Retail Perspective: Nordstrom’s Role in Distribution

Retailers like Nordstrom have accelerated the adoption of both sportstyle and gorpcore trends. By merchandising technical and performance brands, including ASICS, Salomon, On Running, HOKA, and Arc'teryx, in fashion-first ways, Nordstrom has positioned these items as style essentials rather than niche gear.

Particl data shows that top-performing SKUs at Nordstrom often come from these crossover brands, with models like the GEL-Kayano 14, Salomon XT-6, and HOKA Bondi 8 leading the charge. Nordstrom’s role as a style tastemaker has helped normalize trail shoes and retro runners in streetwear and luxury-adjacent spaces.

Salomon Sales at Nordstrom (Apr 2024 – Jun 2025)

Monthly online revenue from Salomon products sold on Nordstrom.com (in millions USD)

Conclusion

As brands continue to blur the line between performance and style, sportstyle and gorpcore have emerged as overlapping but distinct trends reshaping sneaker and outerwear culture. Sportstyle emphasizes engineered comfort with a fashion-first twist. Gorpcore celebrates the raw functionality of outdoor gear reimagined for urban life.

What’s clear from Particl data is that both trends have significant momentum. Sales are growing, product innovation is strong, and consumer demand is shifting toward hybrid solutions that blend performance, design, and lifestyle seamlessly. Whether on the trails or the sidewalk, these are the shoes and jackets defining 2025.

Sources

- Field Mag – Gorpcore Guide: Brands to Know & How to Style

- Field Mag – Salomon XT-6, Blending Trail Function & Street Style With Ease

- ISPO – Mountaincore and Gorpcore: Symbiosis of Urban Living and Outdoor Fashion

- Hypebeast – ASICS GEL-KAYANO 14 Tag Page

- Highsnobiety – The Many Mutations of Gorpcore

- Highsnobiety – Salomon XT-6 Atmos Sneaker

- Gear Patrol – Why Is Everyone So Obsessed with the Salomon XT-6 Sneaker?

- Financial Times – How Gorpcore Went Girly

- Vogue Business – Would You Chop Wood in Prada? How Luxury Is Reimagining Gorpcore

- Glamour – It’s Time to Jump on the Salomon Sneakers Bandwagon