Tariff Impact Analysis: Inventory, Pricing, and the Months Ahead

Data powered by Particl in collaboration with Cavela

Executive Summary

Tariffs are no longer just a trade policy headline. They are reshaping how brands plan inventory, set prices, and manage sourcing risk. With consumer demand under pressure and costs rising, brands are being forced to choose between protecting margin or protecting customers.

In this report, we use SKU-level retail data from Particl and sourcing intelligence from Cavela to examine how tariffs are influencing inventory volatility, price movements, and category-level exposure. Together, these insights show which brands are adapting, which categories are most vulnerable, and whether consumer-facing price hikes are inevitable.

Our Proposition

Tariffs are the new frontline of margin pressure. Brands that fail to adapt sourcing and pricing strategies will see erosion in both profitability and customer trust.

Particl’s data shows that inventories across the top 250 online brands have swung sharply in 2025, with pronounced drops aligning with tariff announcements. At the same time, average selling prices have begun to trend upward, while out-of-stock rates are hitting multi-year highs — clear signals that brands can no longer fully absorb rising costs.

Cavela brings the sourcing lens. As an AI-powered sourcing platform, Cavela connects brands with qualified suppliers, manages negotiations, and ensures onsite quality control. Their insights highlight how sourcing strategies are shifting — and where brands still have levers to pull.

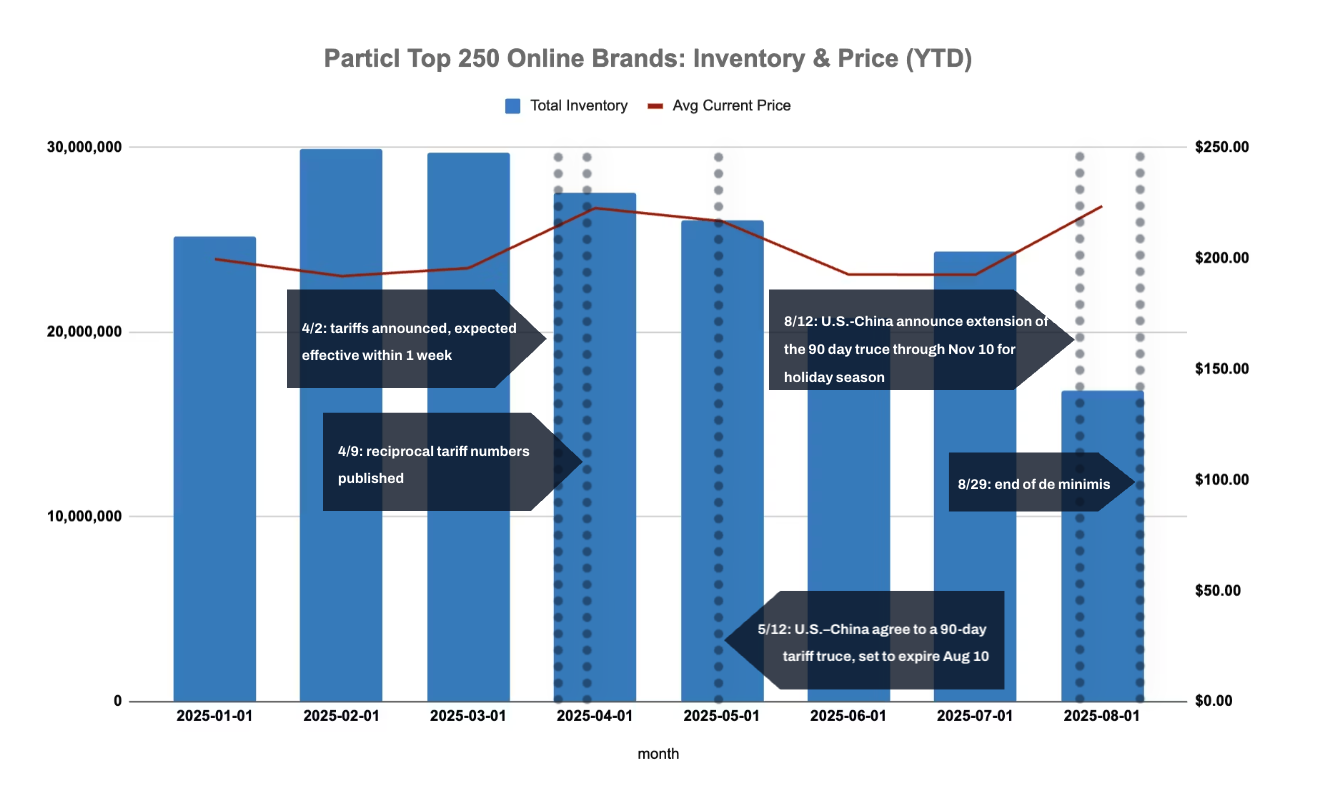

Total online inventory and average current price for the top 250 online brands (Jan–Aug 2025).

Source: Particl

I. Inventory Volatility

Tariff announcements have driven swings in purchasing behavior:

- April 2025: Reciprocal tariffs announced. Brands paused purchase orders and inventories dipped.

- May–July 2025: A 90-day U.S.–China tariff truce created a scramble to place orders before the window closed, leading to a visible July inventory spike in the chart above.

- August 2025: As the truce neared expiration, inventories collapsed. When the truce was unexpectedly extended, many brands were caught flat-footed.

Cavela notes that these whiplash movements reflect an overreliance on single-country supply chains. Brands with diversified sourcing footprints weathered volatility better.

II. Pricing Dynamics

The effect on pricing has been more gradual, but increasingly visible:

- Early 2025: Brands absorbed higher costs, wary of consumer backlash.

- Q2 2025: Small, temporary price hikes tested consumer tolerance.

- Q3 2025 onward: With stock buffers gone and de minimis closed, brands are now passing through more of the cost burden. The chart shows sharper lifts beginning in late Q2, with August reaching the highest average prices YTD.

Cavela highlights that pricing discipline is tied to sourcing flexibility. Brands with multi-country supplier bases have more room to balance margin and consumer price sensitivity.

III. Category Deep Dive

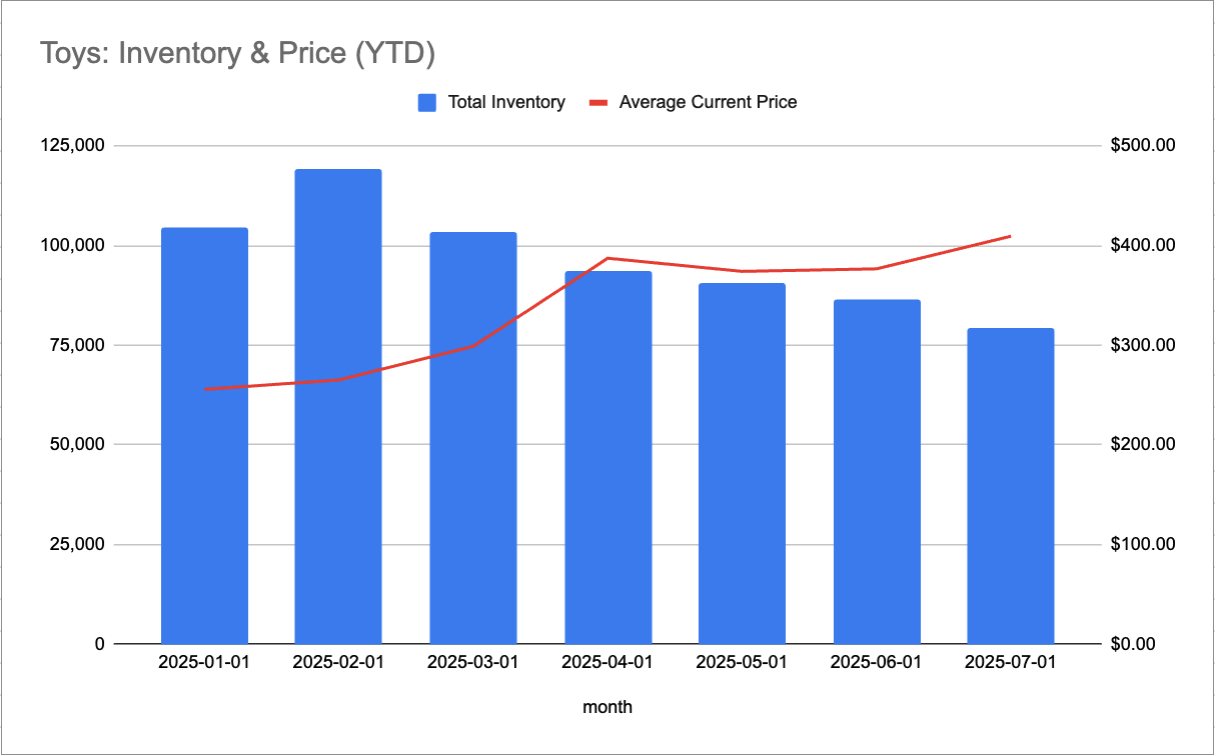

Toys

Toys show steady inventory decline with upward price pressure.

Source: Particl

High vulnerability: Heavy China dependence, long lead times, and Q4 seasonality make this category particularly sensitive to tariff timing. The chart shows inventories trending down steadily while prices climb, reflecting reliance on $<800 shipments that are no longer exempt. Tariffs here are compounding peak-season risk, where mistimed POs could mean stockouts during holiday demand.

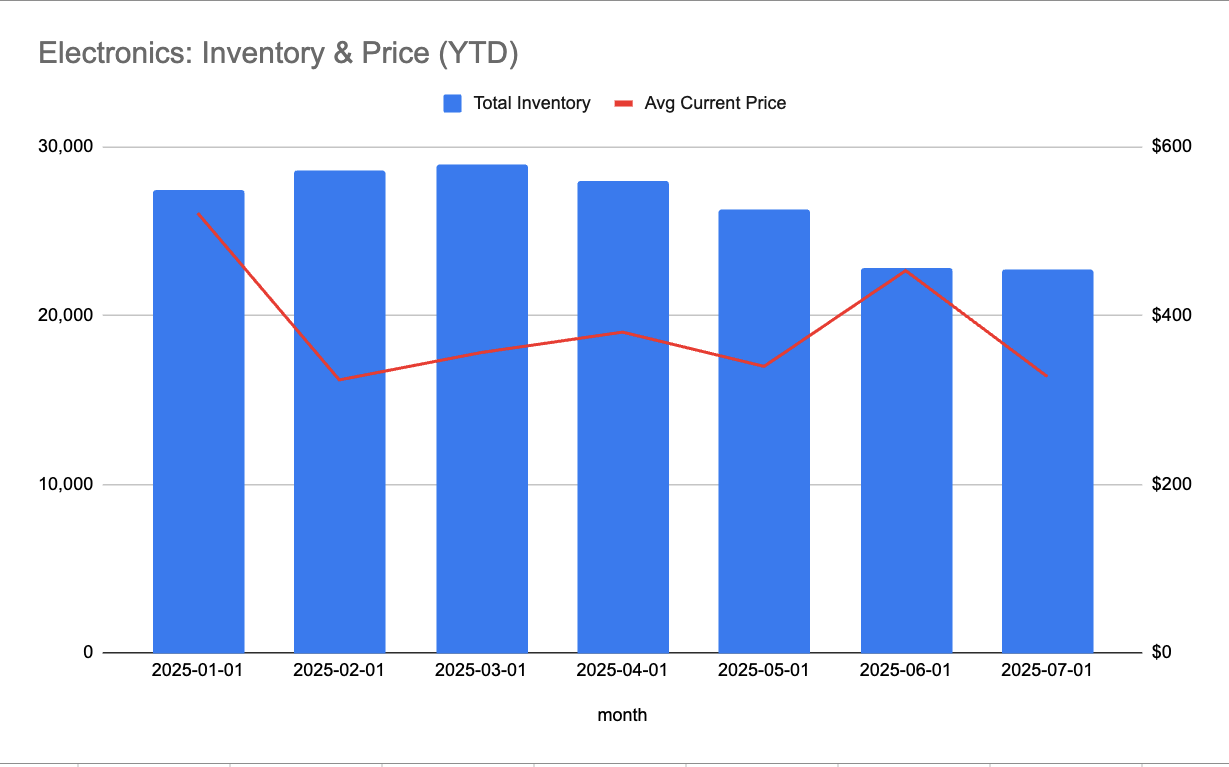

Electronics

Electronics show sharper price volatility due to thin margins.

Source: Particl

High vulnerability: Thin margins and multi-part supply chains mean tariffs flow quickly into consumer prices. The chart highlights sharper price swings relative to inventory levels, underscoring how little absorption capacity exists in this sector. Accessories and peripherals, often reliant on cross-border parcel shipments, face additional expedited costs under duties.

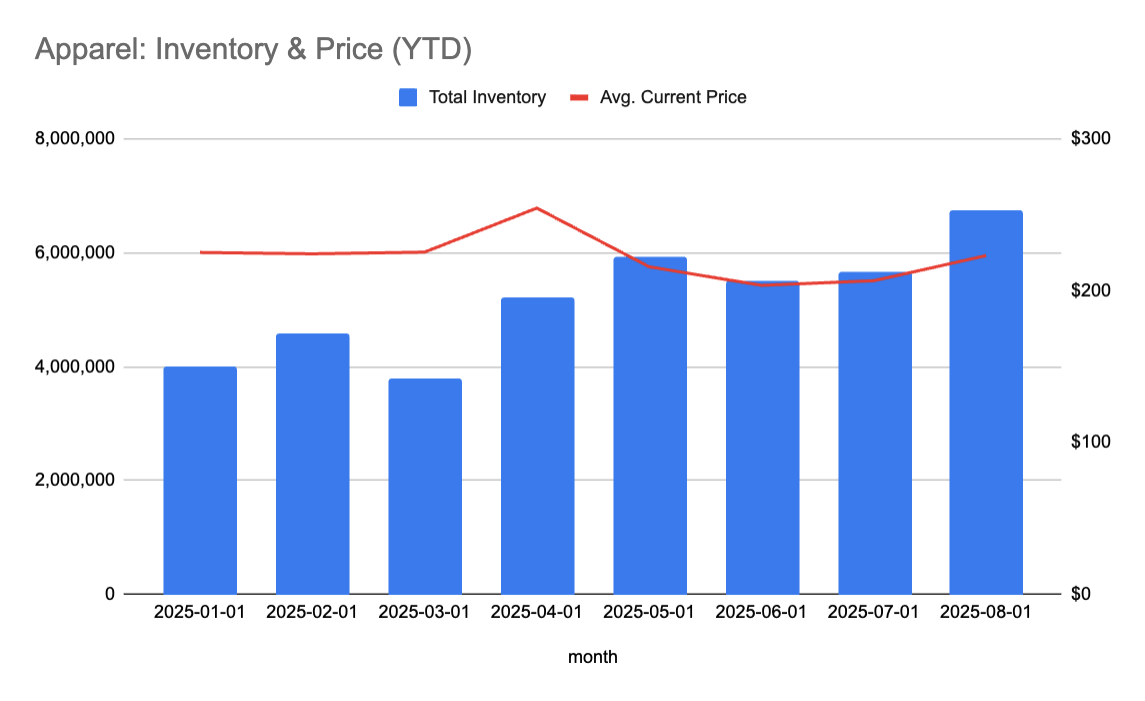

Apparel

Apparel shows moderate volatility, with sourcing diversification providing some resilience.

Source: Particl

Medium vulnerability: Apparel shows moderate volatility, supported by sourcing diversification into Vietnam, India, and Latin America. The chart indicates less severe inventory disruption than toys or electronics, but rising prices mid-year highlight input cost pressure. Still, reliance on trims and fabrics from China — plus parcel-based DTC distribution — leaves the category exposed.

Beauty

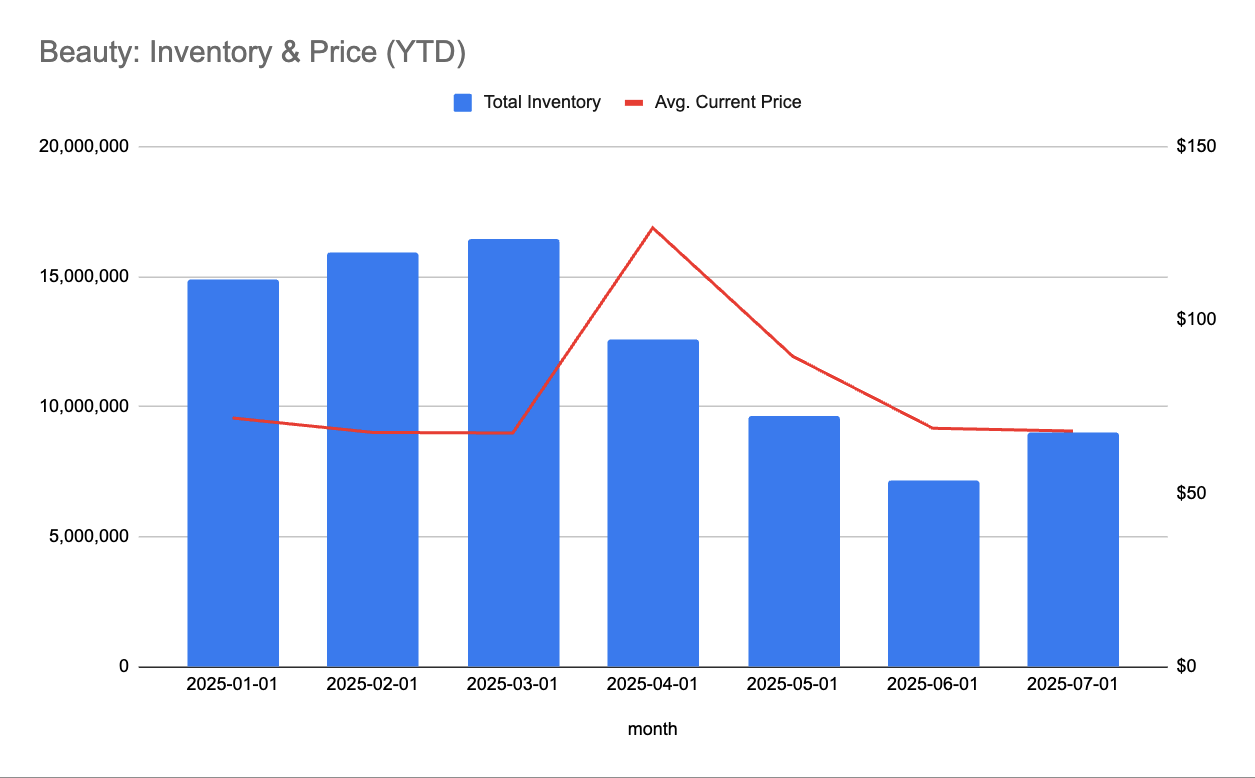

Beauty inventories dipped steeply in spring, with pricing spikes tied to packaging and raw material costs.

Source: Particl

Medium vulnerability: Beauty inventories dipped sharply in spring, while pricing spiked alongside packaging and raw material costs. The chart shows volatility stabilizing mid-year, thanks to higher gross margins that allow some cost absorption. Indie DTC brands, however, remain disproportionately at risk due to reliance on $<800 parcel shipments and imported packaging.

IV. Out-of-Stock Analysis

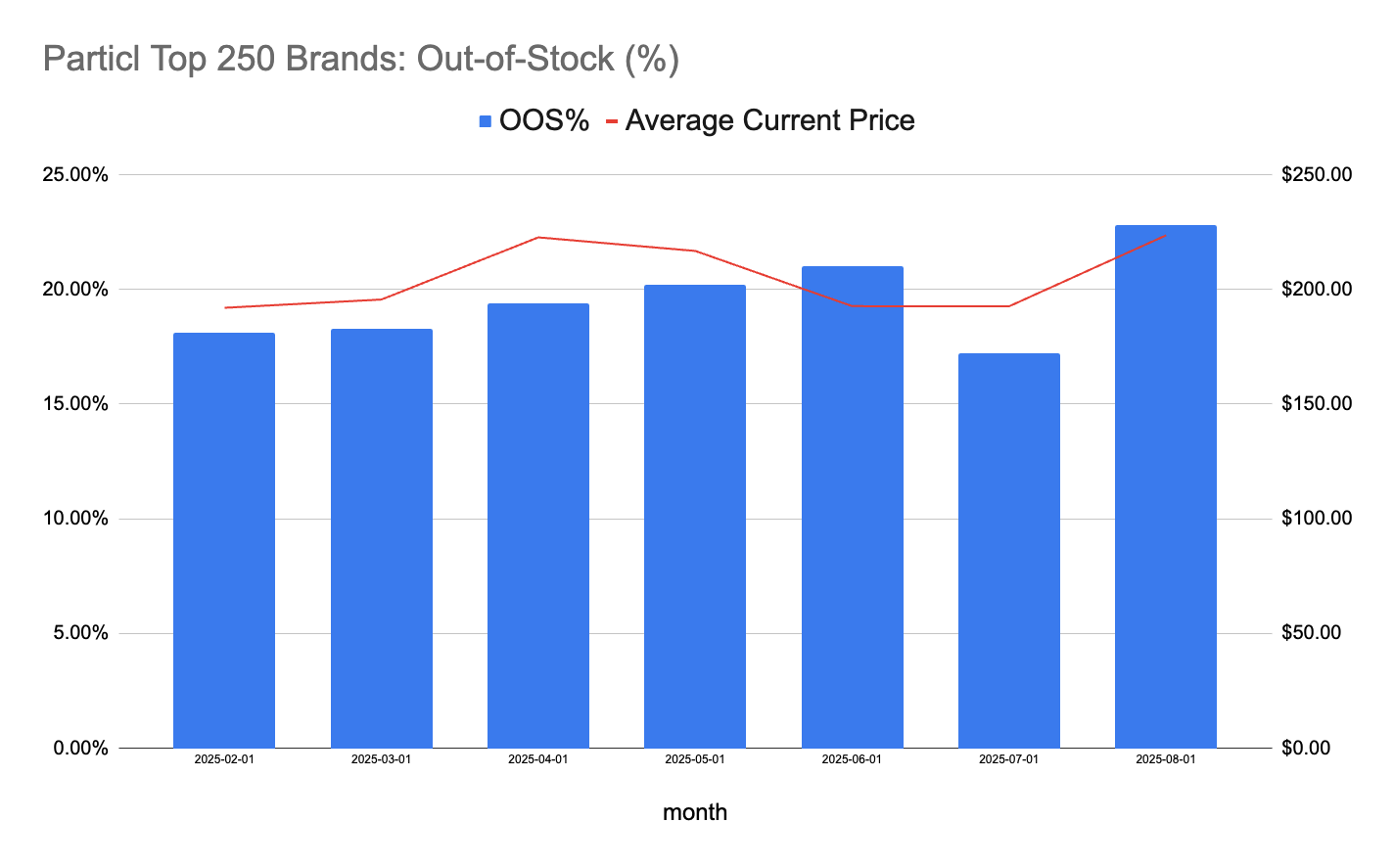

Share of SKUs out of stock each month among the top 250 online brands, compared to average price trends.

Source: Particl

Out-of-stock rates climbed in April and June, tracking directly with tariff announcements. The July relief is visible in the chart, as shipments landed during the truce window. By August, OOS levels spiked to the highest YTD, reinforcing how fragile buffers have become. Prices followed these scarcity patterns upward, highlighting the direct link between tariffs, supply constraints, and consumer-facing cost increases.

Cavela underscores that inventory buffers and supplier diversification are critical in reducing OOS volatility.

V. The Months Ahead

Brands cannot keep shielding customers indefinitely. With inventories at multi-year lows and OOS percentages peaking, the path forward points to higher consumer prices. The key unknowns are timing and scale, both of which will be influenced by competitor actions and geopolitical shifts.

VI. The Solution: Cavela + Particl

Cavela's Sourcing Advantage

Cavela helps brands adapt sourcing strategies in real time. Their AI-powered platform:

- Connects brands with vetted, cost-effective suppliers

- Manages supplier negotiations and production timelines

- Provides on-site quality assurance and compliance monitoring

Particl's Commercial Lens

Particl brings SKU-level visibility across thousands of brands, tracking:

- Inventory and pricing trends across categories

- Out-of-stock pressure points

- Category-level performance benchmarks

Together, Cavela and Particl give brands a sourcing and commercial playbook — Cavela helps secure better cost structures and supplier resilience, while Particl quantifies the commercial impact of tariff-driven shifts.

VII. Call to Action

Tariffs are not going away. They are becoming a permanent part of the operating environment.

Brands that succeed will be those that:

- Diversify sourcing footprints beyond single-country risk

- Use data to time replenishment and manage pricing strategy

- Treat tariffs as a catalyst for smarter procurement and commercial planning

Cavela provides the sourcing intelligence, and Particl provides the commercial clarity. Together, we give brands the tools to turn volatility into opportunity.

Sources

United States Trade Representative (USTR)

Wall Street Journal

Reuters

Bloomberg

Particl Database

Cavela